Keys to understanding the lack of correlation between financial markets and the real economy

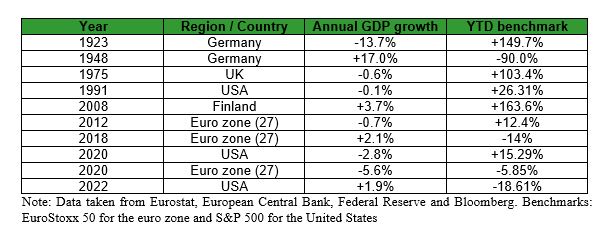

An analysis of historical stock market investment returns and GDP growth suggests that they are not always closely related.

In 2023, inflation emerged as the enemy to beat. The central banks set out to deploy Mario Draghi’s “whatever it takes” maxim to bring inflation back to 2%. With interest rate hikes as the tool, the consensus in the markets was an economic slowdown and a deterioration of financial conditions in 2023.

After 11 rate hikes by the Federal Reserve, and 10 in the case of the European Central Bank, 2023 closed with stock markets at all-time highs. In the US, the S&P 500 rebounded 25%, while in Europe, the EuroStoxx rose by 18%.

The situation turned extreme in the case of the emerging markets. The Argentinean Merval gained +347% and, in Venezuela, the IBC (its benchmark index) closed the year at +169%. Despite the stock market frenzy, their economies are not global benchmarks. According to the World Bank, Argentina’s GDP fell 2.5%, while in Venezuela, seven out of ten households (67.97%) were living in extreme poverty in 2021, as reported by the United Nations Office for the Coordination of Humanitarian Affairs.

So, what explains the disconnect between financial markets and the real economy?

The relationship between the economy and markets

Stock markets are designed to stimulate economic growth by increasing domestic savings and raising the volume of investment. These markets, in particular, can promote economic expansion to offer developing companies a more affordable way to raise cash. In addition, companies in countries with well-established stock markets are less dependent on bank financing, which reduces the possibility of a credit crunch.

The rate of return for savers increases and makes saving more attractive if efficient securities markets allow resources to be allocated to investment projects with higher returns. Thus, more savings are directed towards the corporate sector. Through the absorption mechanism, the stock market is also expected to ensure that previous investments are used as efficiently as possible. Theoretically, the best guarantee of efficiency in asset utilisation is expected from a free market in corporate control, as this provides financial discipline.

Economic indicators, such as the industrial production index, inflation and interest rates are closely related to stock market fluctuations. In the case of interest rate changes, these are used to discount future cash flows, so they also affect securities prices. Again, this means that the prices may not necessarily reflect a company’s growth projections. Nevertheless, this relationship is directional, as large changes in the markets can have an impact on the real economy and vice versa.

Similarly, valuations and economic data are not everything in stock markets, as evidenced by what is known as excess volatility, first identified by Robert Shiller in 1981, which is possibly the greatest paradox in financial economics. This excess volatility translates as the level of volatility above that predicted by efficient market theorists, attributed to the psychological behaviour of investors.

Market crashes linked to dramatic events

An analysis of historical stock market investment returns and GDP growth suggests that they are not always closely related. Large-scale stock market crashes have generally been linked to dramatic events, such as a world war; Germany’s currency problems in 1924 and 1948; runaway inflation, like in the UK in 1975; and even pandemics and their consequences, like in 2020. In some of these cases, GDP also saw significant declines, whereas, in others, production increased in that year.

Of particular note was the situation during 2020, when both the Federal Reserve and the European Central Bank significantly expanded their asset purchase programmes. These non-conventional monetary policy measures were intended to improve market valuations, either by improving the fundamental outlook for companies or reducing the discount rates. Despite the disconnect between stock markets and real indicators, any improvement in fundamental outlook was expected to disproportionately benefit listed companies.

Although these central bank programmes arguably played a crucial role in limiting the financial instability during the pandemic, they did not prevent a decline in listed companies’ profit forecasts. The discrepancy between the trajectory of returns explained by medium-term earnings projections and actual returns led to a divergence.

The programmes also had a meaningful impact on discount rates, causing them to fall sharply. The decline in discount rates is seen as the effect of falling interest rates, an important factor behind the bullish movement in the stock markets in both the US and Europe.

The impact of emotions on markets

In recent years, the major indices have seen large inflows. In this regard, Richard Thaler underlines the impact of emotions on the financial markets. He introduces the concept of “limited rationality”, which suggests that individuals have limited cognitive capacity and often make decisions based on heuristics or empirical rules rather than on exhaustive analysis. In the context of markets, emotions like fear, over-confidence and herd behaviour can cause inefficiencies and deviations from core values. Thaler’s ideas question the efficient market hypothesis and underscore the importance of understanding human psychology and emotions to explain market phenomena.

In short, Thaler’s thesis highlights the importance of incorporating behavioural factors and emotions into economic models. This provides a more accurate description of the workings of individuals and the markets, thus adding new variables that can explain the behaviour of stock market indices.

Ultimately, the predictive power of the stock market is far from perfect. Throughout history, there has been considerable volatility in prices, indicating uncertainty about the future. Historical patterns suggest that the stock market may be a useful indicator of the real economy, but we must be cautious about making bold predictions given the greater uncertainty we are facing in today’s markets.